Content

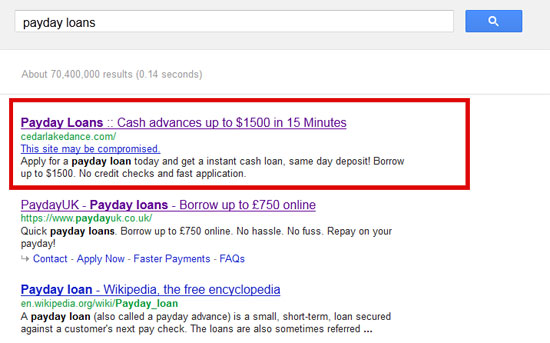

People are constantly hit with unexpected expenses at the most inconvenient times in their lives. Payday loans are then obtained in order to get these individuals through said emergency. Before you rush out to get a payday loan for that unexpected expense, you should know the pros as well as the cons that come with signing on that dotted line.

- Nearly everyone who visits a payday lender has been there before.

- For instance, cable is a good place to start eliminating expenses.

- Obviously, all of this means taking out a payday loan is very bad for your finances.

This is why you have to know exactly how much you can expect to pay in interest before you contract the loan and get the best deal possible. If you do borrow large quantities of money for long periods of time, then the arrangement fee eventually becomes insignificant as a percentage of the loan and the APR falls. Payday loans online via sites like LoanPig and fill out an application, which will usually only take 30 minutes to complete. Unlike car loans and mortgage loans that are only intended for your car and house alone, payday loans can be used for whatever purpose you want.

Texas Home Equity Line Of Credit Rules

Upgrade is one of the best online personal loans for bad credit lenders. Whether you have a good or poor credit rating, Upgrade looks https://creditcardloansppi.co.uk beyond your credit score and will match you with a direct lender that offers you a low competitive interest rate. The company’s focus is to connect borrowers with a poor credit score with online lenders that are ready to offer unsecured personal loans. The lenders offer competitive interest rates, flexible repayment terms, and a fast online application process.

Online lenders offer debt consolidation loans to borrowers in all credit brackets. You’ll still want to make sure the APR is lower than the combined interest rate of your current debts. However, if you make your monthly payments on time and in full, the net effect should be positive, especially if you’re consolidating credit card debt.

Review Lender Loan Offer

The student who is taking out the loan will be responsible for paying back the loan in full. You will be able to borrow up to the full cost of attendance of the college of your choice, with interest, for each year you take out the loan. Parents who use this loan should only consider a public college that is more affordable and your child will attend. If your child is able to pay for college, borrowing isn’t the right option for your family.

Considering Taking A Payday Loan? Weigh The Pros And Cons First

The postdated check will then be set to coincide with the payroll deposit, ensuring that the post-dated check will clear the account. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Many or all of the products here are from our partners that pay us a commission. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

When you compare unsecured loans, you won’t save as much money, but you could still save hundreds of dollars. Different lenders have different product features and cost charges on their loans. Payday loans might be an excellent way of paying an unexpected expense.

Her work has been featured on major outlets including MSN Money, CNBC, and USA Today. The reason for that is the growing number of financial disruptions in people of all ages. The financial crisis in many countries as well as in the USA means borrowers need to search for different ways to get extra financial assistance. So, even if you’ve been rejected by banks, you can try your luck through online lending platforms and companies.

This is why it is often such a popular choice for people experiencing financial difficulty who need a quick money boost to stay afloat. Payday lenders take on a lot of risk, because they don’t check your ability to pay back the loan. Because of this, they normally charge very high interest rates for payday loans, and they may also charge high fees if you miss your repayments. This can be dangerous for borrowers, because it can mean that you’ll need to borrow more money to cover the cost of the first loan.

To get your best rate, you must wait until your driving record is clear and then look for a new auto insurance provider. The cost will be significantly lower; you will save a lot on your premiums. Smart drivers hunting for auto insurance bargains familiarize themselves with all of the different varieties of insurance available. A driver who lacks a thorough understanding of the types of coverage will find it very hard to save money.